Acquisition project | Setu

Note:

Project details:

- Company Name: Setu

- Website: https://setu.co/

- Product: Reverse Penny Drop

- Company Stage: Mature stage Scaling

- Type: B2B

- Note: This is a product open for entities regulated under SEBI and RBI only.

Elevator Pitch for the Product: RPD

Hi, I'm a Growth associate at Setu by PineLabs. We are an API Infra company and help businesses with the fastest onboarding, collections, and underwriting journeys. Reverse Pennydrop is an API used for bank account verification via UPI. Our clients have seen 30% higher success rates in verifying their customers' bank accounts while availing additional details like IFSC code, Payer VPA and much more.

What Does your product do? - Core Value Proposition

Reverse Penny drop API verifies the bank account details through the UPI trails. The customer transacts INR 1 payment payment to a specific VPA registered for your organization via any UPI app, generated by the business which is refunded within 24-48 hours. In response, we provide the complete name, bank account details, and IFSC details. on via any UPI app, generated by the business which is refunded within 24-48 hours.

Ideal Customer Profile:

Note: The rest of the sections of this project only refers to broking industry. I feel we have not gained the PMF for the entities that have a license from RBI. NBFCs is an ICp but which industry in lending , is something we are still figuring outthe .

ICP industry | Broking | NBFC |

Offering | Investments | Lending (Any) |

License holder | SEBI RIA | RBI |

Company size | 50 - 4000 | 500-7000 |

Must have | Digital App/ Website | Digital App/ Website |

Funding | Series C | Series A |

Decision makers | CTO, CPO | CTO, VP |

Blockers | Legal, Infosec | Legal, Compliance, CRO |

Influencers | Sales team, VP | CPO |

Current solutions | Pennydrop API, Penniless API, Bank statement upload | Pennydrop API, Penniless API , Bank statement upload |

Stage of the company | Early scaling / Mature Scaling | Matured scaling |

Products used in workspace | Google Analytics, Mailchimp | LMS, BSA, PG |

Preferred outreach channels | SEO, WOM, Case Study, Blogs | SEO, WOM, Case Study, Blogs |

Pain Points | Slow response, The customer has to provide a lot of information. The journey is broken | Slow response, The customer has to provide a lot of information. The journey is broken |

Where do they spend time? | Commuting to the office, Online news sites, Regulatory news, Data analysis | Commuting to the office, Team collaborations, Decision making |

Industry Numbers:

TAM: There are a total of 4902 stock brokers in India registered with SEBI as of August 15, 2024.

SAM: There are ~1300 brokers that have an RIA license.

SOM: There are 147 brokers who are active and that fall into our ICP. The list can be found here.

Understanding your users:

This was done via Google meets and phone calls, below is the documentation for the same:

I would not like to reveal the customer name as that is confidential.

Customer name | (Stock Broker) | (Stock Broker) | (Stock Broker) |

|---|---|---|---|

Designation | Product Manager | Product Manager | Chief Product Officer |

Type | Decision Maker | Decision Maker | Decision Maker |

Location | Bangalore | Bangalore | Gurgaon |

Why choose our product? | Innovative, first to the market, word of mouth, had spoken to existing customers, and current partner did not have RPD offering. | Scalability of the APIs, Unique solution, Better customer journey as this was faster. | Cost-effective and higher success rates |

Problem Solved | Easier verification and customer UI/UX journey are much better. | Scalability and user journey. | No External redirection so in line with the security policies. |

Additional details | I got additional details of IFSC not just the bank account | IFSC details are useful while doing the TPV for a transaction. | NA |

Typical day at work | I have day-to-day meetings and collaborate with the engineering team. | Scrum calls and meetings with different teams and stakeholders. | Meetings, and seeing how you can make the user journey better. |

The main reason for the decision | Unique product offering | The ability of the APIs to scale | 2 partner banks at the back-end which gives redundancy and higher success rates. |

Where do they spend their time? | Networking events and consuming news online | Speaking to support teams to see user responses and elevate the product. | Shooting podcasts and networking events. |

In-depth Competitor Analysis

Note: Setu is the first in the industry to build the RPD product, making us the market leader in this space. We've already achieved significant market penetration with only one competitor and are now focused on mature scaling.

Competitor Name | Setu | |

What is the core problem being solved by them? | Bank account Verification, Better user experience, minimal drop-offs in the onboarding journey, minimal downtimes. | Bank account verification, Smoother onboarding and higher success rates. |

Founding Year | 2018 | 2014 |

Total Funding raised | Acquired by Pine Labs | $1M |

What are the products/features/services being offered? | Data Gateway, Payments and Account Aggregator Services | Digital KYC stack, Auto payments, Hyperverge One, Plug and play APIs |

Who are their users? | Groww, ET money, AngelOne, HDFC securities, Mobikwick | NA for RPD mentioned |

What is their pricing model? | Prepaid pricing or a Pay-as you go model | Package pricing with a lot of value added prepositions like Support, access, account Mnaager. You can check the same here |

Which industries do they have customers overall? | Lending, Broking, Banks, Insurance, Fintech, Wealthtech | Fintech, Gaming, Crypto, Logistics, Marketplaces, Remmitance |

What have they displayed about the RPD product? | Only the solution RPD and a description of the mechanism | Pain points with existing solutions, Input and output, FAQs. |

Acquisition Channels: (Mature Scaling stage):

Organic Search (SEO)

The main channel working for our organization is SEO on google search.

Key word research:

All the data was surfed online via Semrush and Ubersuggests.

Type of search | Keyword | Search volume (avg monthly) | Difficulty to rank on seo | Avg cost per click | Website Ranking | Website land to conversion rate | Comments |

Use case | Bank account Verification / Verify Bank account | 480 | Difficult | INR 15 | Poor - not in Top 50 | 0% | This is very poor rating, we will have to optimise for this to increadse visibility on web for direct use case. |

Competitor | Hyperverge | 9,900 | Medium | INR 32.65 | 1 | NA | Great SEO at their end as well. First few link are of their website and docs. |

Your product | Reverse Penny drop | 170 | Easy | INR 0 | 2 | NA | Could not find the data for the conversion rate. |

Penny Drop | 1300 | Easy | INR 0.84 | 23 | NA | Even though Penny drop is a sepearte offering, I believe optimising for this key word will result in a higher rank. | |

Your brand name | Setu | 35,000 | Difficult | INR 1230 | 1 | 15% | Our main competitor for our brand name is Setu - nutriton. |

SEO Analysis:

ICP directly searches for our product or brand as it is a product served to a very niche customer base. Regulatory requirements also add up in this scenario.

Optimization for Reverse Pennydrop and website/docs changes proposed for a higher ranking on keywords.

- There is no mention of Reverse penny drop on the website.

- In penny drop verification, the mechanism should be elaborated. Instead of "Your business deposits INR 1 to the customer-provided bank account number to verify it. We can tweak it as " Your business deposits INR 1 to the customer's bank account, and if the transaction goes through it's a valid account. If not, the details provided are invalid. We have a success rate of 100% with this method. (Success rates add more credibility to this)

- For Reverse Penny Drop API, we should mention the CVP of the product backed up by numbers and case studies by existing customers.

Narration: (WebPage)

Reverse Penny Drop

The customer transacts INR 1 payment payment to a specific VPA registered for your organization via any UPI app, generated by the business which is refunded within 24-48 hours.

Request:

INR 1 transaction (Refunded within 24-48 hours)

Response:

- Full name (up to 200 characters)

- Account number

- Account type

- Payer VPA

- Complete IFSC details

Features:

- Best industry uptimes: 2 partner banks in the back end, redundancy at all times.

- Detailed and clean API documentation: Here

- Unlimited Sandbox access: Get started here

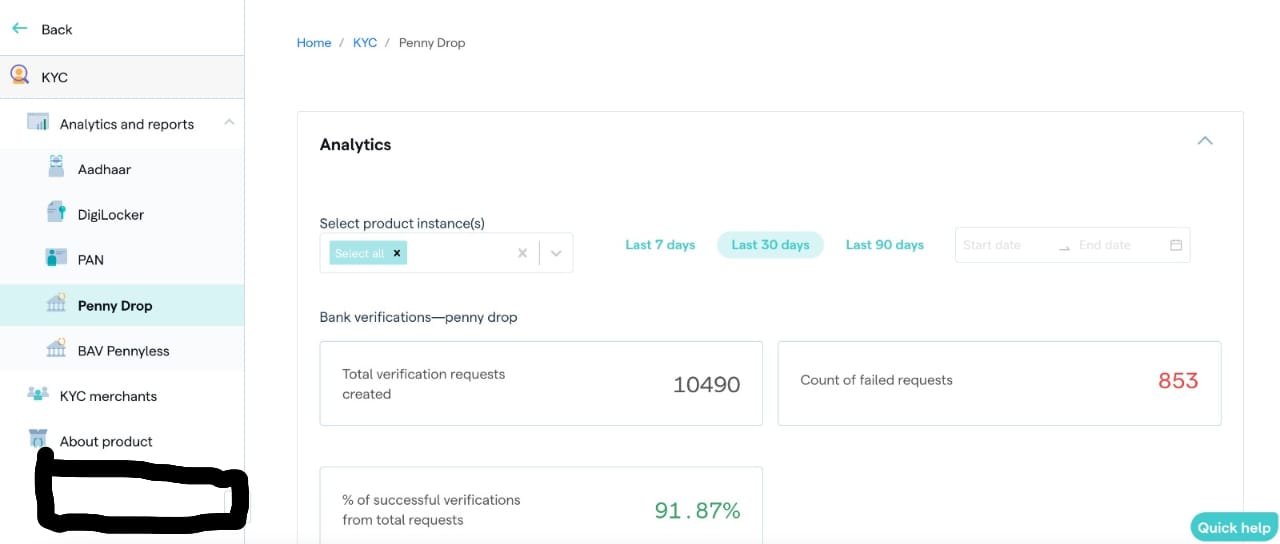

- Analytics for conversions: Access analytics specific to a user’s verification status.

CTA’s on the page:

- Contact Sales - (Auto mail triggered)

- Checkout API documentation - (Detailed and clear documentation)

- Get Started with Sandbox - (Have complete access to unlimited SB, no need to contact anyone from the organization.)

Additional details on the page

Figma flow of the User journey. (As shown to the customer)

Below is the Narration of the Figma flow:

Image ALT text: Reverse Penny drop flow

Referral Program

Why? - We get 60% of our customers through Word of mouth. We currently do not have a referral program for our customers and I propose to boost this through a referral program for our Happy customers.

AHA moment of the product:

The user experience. Unlike other methods, the customer does not have to enter any bank account details like Account number or IFSC code. A simple INR 1 transaction serves for the verification.

Platform Currency:

Setu charges for every successful verification, so the platform currency will be free verification or less charge per verification.

Who will I ask for a referral?

You can check out the flow here:

https://whimsical.com/customer-is-live-on-rpd-3bvVqW7TtrdCWkZw8F7BKNHow will the user discover the referral program?

The user will discover this via Bridge, where he / she checks the reports and analytics frequently.

The referral program will be open to customers only after they have pushed <80% of their volumes on the Setu stack and we have checked their NPS and CSAT scores.

Where will they discover?

Text displayed: Refer a Buisness

Communications: Through Bridge and via Email.

Template for communication via Email:

Subject: You are eligible to gain a 5% discount

Hi (Name),

Hope all is well!

We are happy to announce that you are eligible to avail a 10% discount on your current RPD pricing with us. Your continuous trust and growth have impacted our business revenue immensely and we have designed a referral program for you.

How to avail of the discount?

Login to Bridge -> In the him section select "Refer a Business" -> Enter the mail address of the POC/friend and our Sales team will reach out to them immediately.

You will be able to view the progress on your referral via Bridge and will be able to send reminders for the same in case we see this not moving.

Terms and conditions:

The referral should be live and transact a minimum of 5000 verifications for 2 consecutive months and should hold a 1-year agreement with Setu.

CTA:

Avail Discount: Invite via Bridge

Template for the friend/business who has been referred.

Subject: (name of the person who referred) Wants you to reduce drop-offs in your onboarding journey

Hi (Name),

Sorry to come unannounced to your inbox. We heard from (Name) that your customers drop off at the Bank account verification step during the onboarding journey. We believe the main reason is that the customer does not want to make an effort to enter their account number and IFSC details.

What if I told you your customers can skip that step and verify their bank accounts with just an INR 1 transaction through any UPI app, which is refunded within 24-48 hours? Additionally, you get the Complete account holder name and IFSC details as well.

Check out the flow for Reverse Penny drop here. (Figma Flow attached).

CTA: Reply to this e-mail to start seeing minimal drop-offs in your user journey.

Tracking of the user journey:

Stages:

- Add an email to refer a friend

- Email sent

- Sales Connect

- Business proposal made

- Evaluation of the proposal

- Testing the product

- Agreements vetting stage

- Agreements signed

- Product integration stage

- Live Stage

Nudge - Reminder to complete the stage they are at.

Dashboard on the referral page for the customer referred who is live

Month | Transactions |

August | >5000 |

September | <5000 |

Side note:

I enjoyed designing the referral program the most. I will surely go back and ask the relevant people in my organization of why we do not have a referral program and explain to them why I think we should implement one!

Brand focused courses

Great brands aren't built on clicks. They're built on trust. Craft narratives that resonate, campaigns that stand out, and brands that last.

All courses

Master every lever of growth — from acquisition to retention, data to events. Pick a course, go deep, and apply it to your business right away.

Explore courses by GrowthX

Built by Leaders From Amazon, CRED, Zepto, Hindustan Unilever, Flipkart, paytm & more

Course

Advanced Growth Strategy

Core principles to distribution, user onboarding, retention & monetisation.

58 modules

21 hours

Course

Go to Market

Learn to implement lean, balanced & all out GTM strategies while getting stakeholder buy-in.

17 modules

1 hour

Course

Brand Led Growth

Design your brand wedge & implement it across every customer touchpoint.

15 modules

2 hours

Course

Event Led Growth

Design an end to end strategy to create events that drive revenue growth.

48 modules

1 hour

Course

Growth Model Design

Learn how to break down your North Star metric into actionable input levers and prioritise them.

9 modules

1 hour

Course

Building Growth Teams

Learn how to design your team blueprint, attract, hire & retain great talent

24 modules

1 hour

Course

Data Led Growth

Learn the science of RCA & experimentation design to drive real revenue impact.

12 modules

2 hours

Course

Email marketing

Learn how to set up email as a channel and build the 0 → 1 strategy for email marketing

12 modules

1 hour

Course

Partnership Led Growth

Design product integrations & channel partnerships to drive revenue impact.

27 modules

1 hour

Course

Tech for Growth

Learn to ship better products with engineering & take informed trade-offs.

14 modules

2 hours

Crack a new job or a promotion with ELEVATE

Designed for mid-senior & leadership roles across growth, product, marketing, strategy & business

Learning Resources

Browse 500+ case studies, articles & resources the learning resources that you won't find on the internet.

Patience—you’re about to be impressed.